- Ebay and paypal calculator uk for free#

- Ebay and paypal calculator uk how to#

- Ebay and paypal calculator uk registration#

- Ebay and paypal calculator uk download#

You are required to have an eBay business account for this purpose. Some people purchase the products and services to resell.

Even the VAT you have paid as a seller fee is allowed to be reclaimed.ĮBay Sellers and VAT Charges for the Customers

Ebay and paypal calculator uk registration#

The most beneficial point after VAT registration is that you are allowed to reclaim the VAT amount that you have paid for the products and services. There is no limit on the registration threshold. In the case, your business is outside of the UK and you’re sending products to the UK, you will have to register your business for VAT. While you are submitting your quarterly VAT returns, you will have to submit this payment to HMRC as well. In simple words, once you are done with making your business VAT registered, you are now able to charge VAT on all the services and products that you are selling. The businesses that expect to exceed a certain limit of turnover within 12 months are bound to get VAT registered and reach out to HMRC for this purpose. VAT is charged at a zero rate of 5% on a few products that are sold out in the UK. However, there is an exception in this case. The standard VAT is 20% which is charged as a consumption tax on several products and services sold out in the UK. VAT is the abbreviation of value added tax. Reach out to one of our professionals to get to know what is the best way to use the eBay fee calculator UK for your business.

Ebay and paypal calculator uk how to#

You must be aware of how to define value added tax, what are VAT charges for the sellers that they are allowed to charge on their product purchases, what is eBay fees calculator in the UK and how it works. You should have an understanding of how the eBay fee calculator UK works for you as well.īefore delving further into the discussion, you should be able to know the basic requirements that require your attention if you are a seller on eBay. The standard VAT is 20%, however, it is vital to have an understanding of all the VAT obligations as a seller. This makes a requirement of charging VAT to the customers on any product purchase. Market place retailers are clear here that they will have to pay VAT on sellers’ fees.

Ebay and paypal calculator uk download#

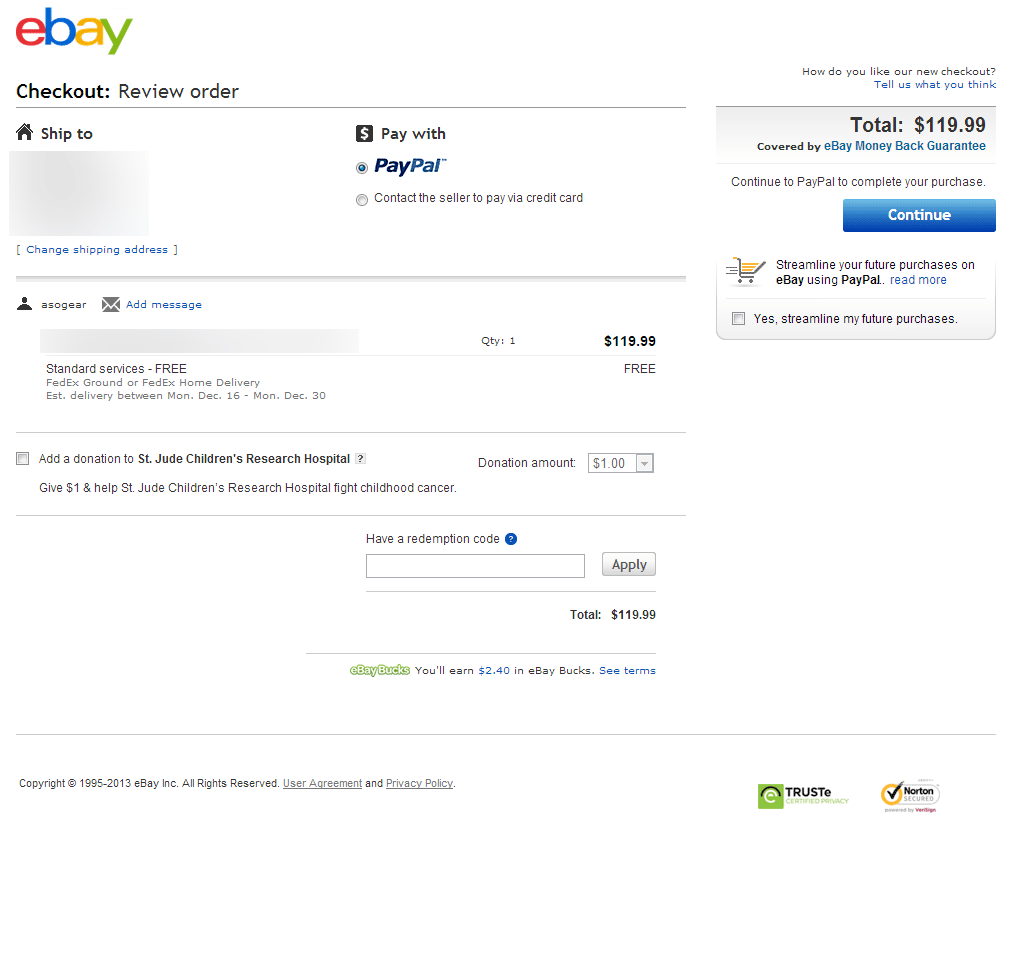

I grant you a personal right to use this web form or download this spreadsheet and copy or modify to suit your needs.In the UK, when you sell any product or service, value added tax which is known as VAT is charged in most cases. Your fees may vary, and you should do your own research according to your personal situation and the item you are selling. If you use the results for any purpose, the responsibility of that use is entirely with you, the user. I make no claims as to the accuracy or completeness for any results produced by this calculator. They are not necessary, but optional listing upgrades can help your listing stand out and attract more buyers.

Sometimes, eBay does hold promotional days or weekends where you can list up to 100 listings with Max £1 selling fees! Which means no matter how much your item sold for, you pay no more than £1 per sale.

Ebay and paypal calculator uk for free#

It may be either actual postage, or how much you spent on the fuel to collect this item. Purchasing Carriage Cost: how much you paid for the delivery of this item.If you didn’t pay anything, leave it blank. Product Purchase Price: how much you paid for the item.I believe fields are self-explanatory, but just in case I will leave short descriptions here. Please note, to have correct calculations amend only the white cells. I will try to keep the spreadsheet up to date, but if you notice any issues, please let me know. This tool will perform standard calculations to show you how much of your sales proceeds will be taken as fees for eBay and PayPal.

0 kommentar(er)

0 kommentar(er)